Homeownership

Roadmap

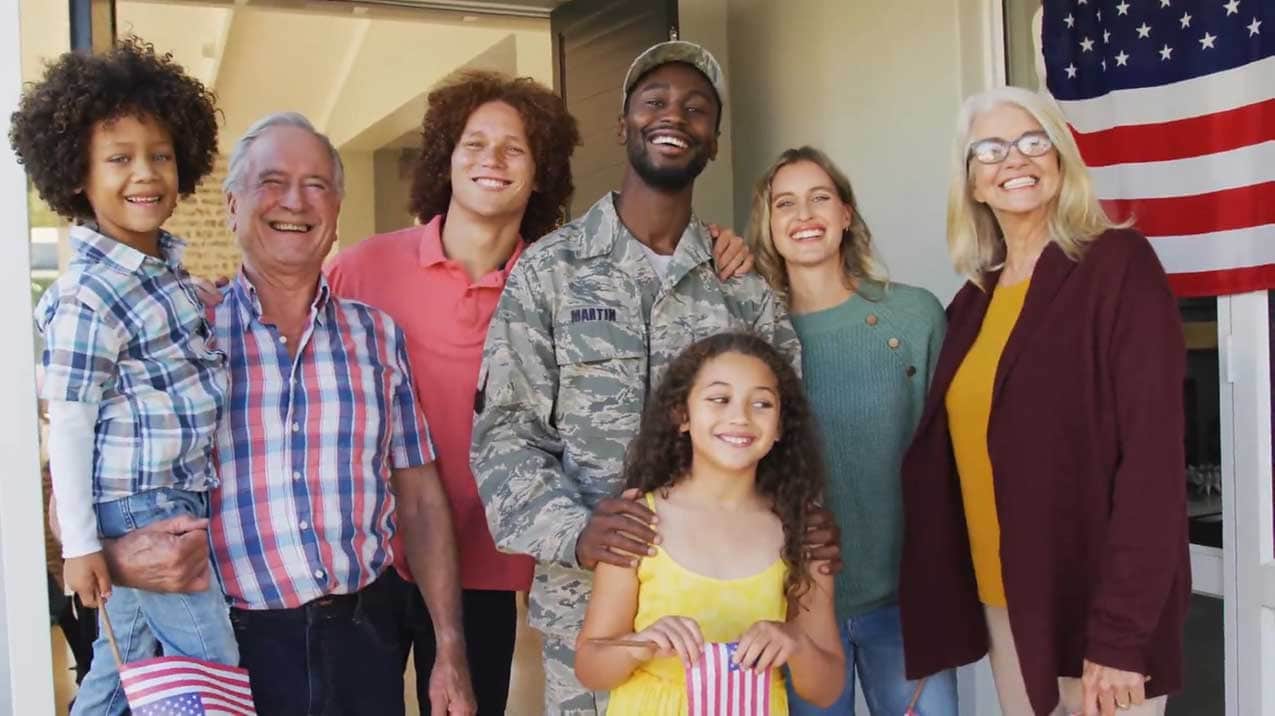

Achieve Your Dream of Homeownership, Despite Challenges with Our Homebuyer Program

A brighter future starts here!

The Royal Commitment:

Mortgage Rate Trends:

A Historical Analysis

Unlock the Power of Numbers

Start Pre-Approval Application More on credit, LTV and Rate Trends

Advanced Mortgage Calculator

Get Pre-Qualified

Fill out our Pre-Qualification Survey to view your mortgage options

[bitform id='26' ]Here, Your Mortgage possibilities are endless!

Down Payment

Assistance

Down Payment Assistance Programs

Get Up To 100% Financing For Your Home!

Visit Our Page

First-Time

Homebuyers

First Time Homebuyer Mortgage Programs

If you are buying a home for the first time, you have come to the right place.

Visit Our Page